A DSA is suitable for you if you are struggling to pay your unsecured debts such as credit cards, loans, overdrafts etc... The main purpose of this solution is to allow you to regain control over your financial affairs in a way that is fair and realistic for you and your creditors.

The first thing we do when you get in touch is have a chat to see what all of your options are to addressing your debts. We will analyse your financial situation and work out what you can realistically afford to pay towards your debts each month, after giving priority to your other living expenses.

If you decide to proceed with a DSA, our Personal Insolvency Practitioners (or PIPs for short) will get to work on your DSA proposal. When the proposal is ready it is sent to the Insolvency Service of Ireland (ISI), the courts and your creditors. When they have all agreed to the DSA, it becomes legally binding and you can start making your lower monthly repayments (usually for 60 months). On completion of the Arrangement, any remaining debts are written off.

If you would like to find out more about a DSA or to find out what other options are available, fill in the form and one of our advisors will call you for a chat. At McCambridge Duffy, we offer free and confidential advice and we do not charge any upfront or consultation fees.

" Fantastic

I have had the most straight forward and quick service, it has been completely unbelievable. I would recommend to anyone if they needed help. Cannot fault the service I have received. All the staff are very understanding of your circumstances and give you reassurance and advice as required. "

Sophie | TrustPilot

Contact us to discuss your situation. We will see if a DSA is your best option. All of advice is free, without obligation and confidential.

Our PIP submits your application to the ISI and court. If happy they will grant your protective certificate. Your PIP then drafts your proposal for your creditors.

Your proposal is sent to your creditors for voting. Atleast 65% of the creditors (by debt value) must vote in favour of the proposal in order for it to be approved.

The ISI & court carry out a final review. Once approved your DSA becomes legally binding and payments start. You will have a case manager for support.

When complete, you will be discharged from your debts. Any outstanding balances will be cleared and you can start over debt free.

You will have 1 affordable monthly payment based on what you can afford.

You and your assets will be legally protected from your unsecured creditors.

We do not charge upfront fees.

Creditor pressure is stopped. Your creditors must deal with your PIP.

All interest and charges are frozen.

Any remaining unpaid debt in the arrangement will be written off on completion.

A DSA can be completed a lot sooner if you can gain access to a lump sum amount to be put towards the debt.

Your credit rating will be affected and you cannot obtain further credit when in the DSA.

If you have a change in circumstances and your creditors do not agree to the amended terms, your DSA could fail.

If you fail to make payments on time or fall into arrears your DSA could fail.

Your DSA will be entered on a public register.

Download our DSA GuideYou can enter a Debt Settlement Arrangement with your creditors when you are considered insolvent. You are considered insolvent when you are unable to pay your debts in full and as of when they fall due. You can be single, married, employed, self-employed, a homeowner or a tenant...

There are certain criteria involved in order to do a Debt Settlement Arrangement, such as debt level and number of creditors, but we can discuss this further when we chat. If a DSA is not suitable, we can recommend other various options for you to consider.

Your DSA payment is calculated by analysing your income and expenses on a monthly basis (not including any debt repayments). We then work out how much money you have left over each month. This left over amount is your potential DSA payment.

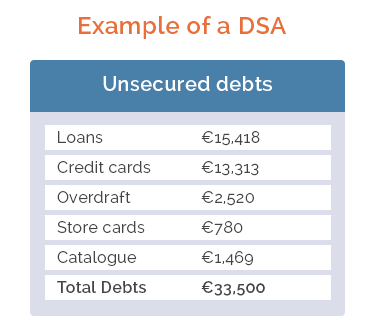

A DSA will only include unsecured debts; there is no limit to the amount of unsecured debt when entering a DSA. There are certain unsecured debts that cannot be included in a DSA and certain unsecured debts require the consent of the creditor before it is entered into a DSA. Secured Debts such as Mortgages cannot be included in a DSA. Unsecured Debts are Debts where the creditor does not have the ability to seize specific assets belonging to the debtor should repayments not be maintained.

Debts allowed in a DSA

65% of your creditors (in value) have to agree to the proposal put forward by the Personal Insolvency Practitioner (“PIP”).

You are considered suitable for a DSA if you meet the following conditions

You are not eligible to seek a DSA should the following requirements apply

When your DSA is in place, your lower repayments will commence. We will assign dedicated case managers who will look after you and your DSA for it's duration. Your case manager will be there to answer any queries you might have throughout the term of the DSA. When your DSA is complete you will be discharged from your debts.

Unlike most other Insolvency providers, we do not charge for our advice and we do not charge upfront fees as we believe this to be unethical. You will never receive a bill from us.

Only if your DSA is accepted will we receive any payments for fees for managing your DSA. If your DSA is not accepted then you pay nothing. Our fees vary depending on your circumstances and they are built into your affordable monthly payment to your creditors. All of this is clearly explained when you chat to us. It is your creditors who determine what we get paid and we cannot draw fees without their approval.

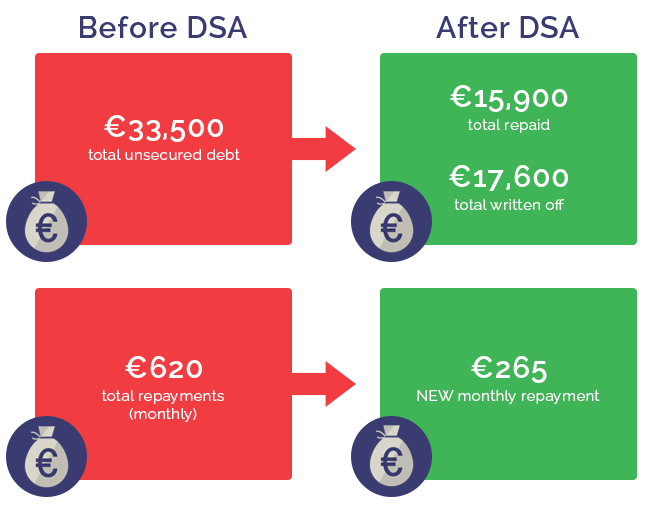

Our client is a single person who was having difficulty repaying total debts of €33,500 on credit cards, loans etc... They were unable to meet the monthly payments on these debts of €620 per month.

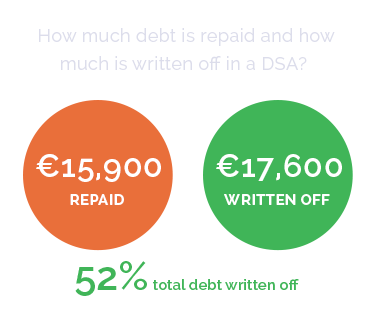

In the DSA we were able to get their payments reduced to a more manageable amount of €265 per month for 60 months which means that €15,900 will be repaid in the DSA.

On completion of her DSA:

the remaining €17,600 of their debts will be written off.

© 2021 McCambridge Duffy All. rights reserved

McCambridge Duffy Limited is a Limited Company registered in Ireland

Registered number 527584

Registered office Suite 6, Spencer House, High Road, Letterkenny, Co. Donegal, F92 V8XC